Beforehand your following home improvement venture, keep reading to ascertain whether or not you ought to sign up for an effective House Depot mastercard. The fresh new small print will get treat your.

If you are a homeowner, chances are high you're sexually always your neighborhood Family Depot. It can become the brand new week-end attraction of preference proper searching to help you spruce up their walls that have another coating off color, increase color on the yard with new vegetation, or eventually repair that leaking faucet. All those check outs can add up in order to a substantial case when the you had been to place it on a credit card. Like any retailers, Domestic Depot dreams you will rack up a tab – naturally labeled cards. The brand new card includes an interesting brighten, but carry out the benefits exceed the disadvantages?

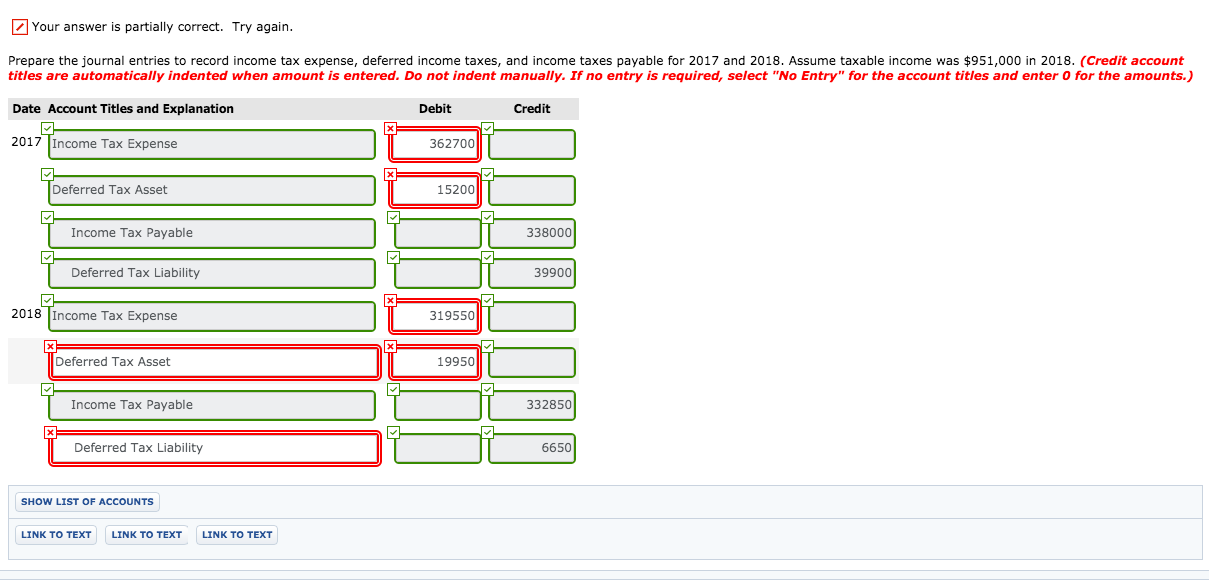

The big mark with the card would be the fact there is absolutely no interest in the event the paid in complete within this 6 months for all the pick of $299 or even more. For cardholders whom repay the balance on these requests ahead of the conclusion new half a dozen-times several months, the card efficiently serves as an appeal-totally free, short-title loan.

Other work with is you can use the new https://paydayloansconnecticut.com/meriden/ cards just like the a handy means to fix keep home-upgrade expenses independent from your own other commands, while you restrict for example purchasing to Home Depot. You really have a need to do this whether it assists your to possess cost management purposes.

Interest rates: The interest rate toward Family Depot bank card is actually theoretically a varying price ranging from % and you may % based your creditworthiness, but step 3 out from the cuatro sections is actually more than 21% (%, %, %). Which is better for the the new deluxe of the normal bank card interest spectrum.

Penalties: If you fail to pay back the entire balance until the six-week period with the attention ends, you are going to need to pay-all of the focus that built-up through the the period on entire completely new harmony. This means you happen to be paying interest actually into portion of your own debt that you currently reduced. The brand new caveat of one's marketing and advertising period differs than simply normal borrowing from the bank notes that offer 0% Annual percentage rate for many weeks – for those who have a balance shortly after those people introductory periods prevent, you only pay desire only on your own a fantastic equilibrium.

A half a dozen-month notice free months is a wonderful perk only if your is also, in reality, repay what you owe at that moment body type. For folks who ignore or enter into monetary dilemmas and also a beneficial difficult time paying the first House Depot purchase, the latest reprieve the shop provided you're moot and you may getting saddled with a high attract costs having multiplied more than half a-year. To have residents that happen to be doing home improvement ideas and need a beneficial month or two to accumulate sufficient bucks to cover them, the newest cards was good choice for as long as these are generally invested in getting vigilant in the paying the bill completely as well as on time.

Home Depot also provides some other credit intended for residents who need borrowing from the bank to have a big renovation, like the kitchen. Called the Home Depot Opportunity Financing, the fresh new credit offer your visibility for approximately $40,100000 inside instructions which you make in this a six-week period, with a predetermined eight.99% Apr. Customers have to make attract-merely costs of these earliest 6 months and also to help you spend everything you straight back more than 84 weeks (eight years). You have made top terms into a car loan, but if you really need restoration financing and just have problems delivering a house security loan, this is exactly a potential solution.

A more flexible and you can down service for your house improve borrowing need would be a credit card that have low interest. Of numerous render a basic chronilogical age of 0% Apr. An alternative choice was an advantages bank card; specific cards offer extra money right back on the purchases at home improve stores during times of the year. As much as possible big date the purchases perfect, you can buy things in return for their expenses.

Leah Norris is actually research specialist from the CreditDonkey, a charge card analysis and you will reviews site. Create to help you Leah Norris during the Realize us with the Facebook and you will Twitter in regards to our most recent posts.

Note: This website is generated you can owing to monetary matchmaking with some from products and you can features mentioned on this website. We may found settlement for folks who shop by way of links inside our blogs. There is no need to make use of the links, however you let support CreditDonkey should you choose.